Deep dive on the GMB (Google My Business) listings of the top- governed city of Cavite Province

A city’s GMB data isn’t just a snapshot of performance—it’s a living trust metric that shapes economic growth. This analysis contains original research by marketing professional Jayson Guevarra.

TL;DR Summary:

- Importance of Analyzing GMB

- 0 Reviews

- Top Categories according to Ratings v.s. Lowest Rated

- Average Ratings of Top Categories according to Total Reviews

- SWOT Analysis

Using keywords from a private survey of what businesses are usually being searched for by Dasmarineños, a list of 1309 GMB listings in the city have been evaluated to form the analysis shared here. This has been AI -assisted ( using tools Gemini and DeepSeek).

Importance of Analyzing Google My Business (GMB) Entries in Dasmariñas, Cavite

Analyzing GMB listings in a rapidly growing city like Dasmarinas provides actionable business, economic, and urban development insights. Here’s why it matters:

1. 🏙️ Economic & Business Intelligence

- Identify High-Demand Sectors

- Top-rated categories (e.g., coffee shops, Italian food) reveal consumer preferences and profitable niches.

- Low-rated sectors (e.g., hospitals, electronics repair) highlight market gaps for new entrants or improvements.

- Spot Investment Opportunities

- Zero-review B2B sectors (e.g., freight, accounting) suggest untapped markets needing digital visibility.

Action: Entrepreneurs and investors can use this data to launch or upgrade businesses where demand outpaces supply.

2. 🛠️ Local Business Improvement

- Benchmark Performance

- Restaurants averaging 4.5+ stars set a quality standard; underperformers (e.g., seafood at 3.7) must adapt.

- Fix Pain Points

- Poor healthcare (2.8) and transport (3.7) ratings signal urgent service upgrades or policy interventions.

Actions: Business owners can analyze competitor reviews to address recurring complaints (e.g., hygiene, wait times). Marketing professionals and consultants may finalize a strategy where they may help the most.

3. 🏗️ Urban Planning & Infrastructure

- Prioritize Development Projects

- Low-rated public services (hospitals, transport) may need government or private-sector investment.

- High demand for parks/resorts (4.5+) supports leisure infrastructure expansion.

Action: City planners can use GMB trends to determine next priorities for allocating resources (e.g., build clinics, improve roads).

4. 📈 Tourism & Marketing Strategies

- Promote Strengths

- Market Dasmarinas’ top-rated cafés, resorts, and event venues to attract tourists and events.

- Address Weaknesses

- Poor hotel ratings (3.7) could deter visitors—training programs for hospitality staff may help.

Action: Tourism boards can create campaigns highlighting highly rated experiences while pushing for upgrades in lagging areas.

5. 🔍 Competitive Advantage

- Stand Out in Crowded Markets

- With many restaurants (avg. 4.28), new entrants must differentiate (e.g., via unique cuisine or service).

- B2B Visibility Gaps

- Professional services (architects, CPAs) with no reviews can dominate locally by optimizing GMB profiles.

Action: Businesses should claim GMB listings, encourage reviews, and highlight specialties (e.g., “#1 Tax Firm in Dasma”).

6. 🗣️ Community Sentiment & Trust

- Build Consumer Confidence

- Low trust in legal (3.5) and used car dealers (3.2) hurts the local economy—transparency initiatives are needed.

- Encourage Civic Engagement

- Residents leaving reviews (even negative ones) provide feedback loops for businesses and policymakers.

Action: Launch local business awards or certifications to incentivize quality (e.g., “Dasma Trusted Clinic” badge).

Key Takeaways for Stakeholders

- Businesses: Optimize GMB profiles, respond to reviews, and compete on quality.

- Investors: Target high-growth, high-rating sectors (F&B, leisure) or fix broken markets (healthcare, transport).

- Government: Use data to guide infrastructure projects and consumer protection policies.

- Tourism Groups: Promote top-rated attractions while advocating for weak-point upgrades.

Final Tip: Regular GMB analysis helps Dasmarinas stay ahead of trends, turning data into growth strategies.

IMPORTANT NOTE: The GMB business profiles are retrieved and accurate as of June 20, 2025.

0 Reviews

Here are the top 20 business categories with 0 reviews in the dataset:

- Restaurant

- Warehouse

- Freight Forwarding Agency

- Transportation service

- Business management consultant

- Shipping company

- Corporate office

- Accounting firm

- Accountant

- Certified public accountant

- Bookkeeping service

- Tax consultant

- Tax preparation service

- Legal services

- Architectural designer

- Architecture firm

- Architect

- Real Estate Builders & Construction Company

- Marketing agency

- Internet marketing service

Why Do These 20 Business Categories Have Zero Reviews?

The absence of reviews for these categories—despite their presence in Dasmarinas—suggests several possible explanations:

1. B2B (Business-to-Business) Dominance

Many of these services primarily cater to other businesses rather than individual consumers, who are less likely to leave online reviews.

- Examples:

- Freight forwarding, shipping companies, corporate offices

- Accounting firms, tax consultants, business management consultants

- Architectural firms, real estate builders, marketing agencies

Why?

- B2B transactions are relationship-driven, often relying on contracts/referrals rather than public reviews.

- Clients may leave feedback privately or through professional networks (LinkedIn, industry surveys).

2. Low Consumer Engagement with Professional Services

Categories like legal services, accounting, and architecture are:

- Used infrequently (people don’t hire architects or tax consultants daily).

- Sensitive in nature (clients may avoid public reviews for privacy).

- Evaluated through word-of-mouth (trusted referrals > online ratings).

Example:

- A person hiring a CPA for tax filing is unlikely to leave a Google review but might recommend them privately.

3. New or Underdeveloped Markets

Some industries may be emerging or underrepresented in Dasmarinas:

- Internet marketing services (despite high demand elsewhere) might still be growing locally.

- Real estate construction projects may be long-term, with few completed clients ready to review.

Why?

- Startups or niche businesses may not yet have a review base.

4. Industry Norms Against Public Reviews

Certain professions discourage public feedback due to:

- Confidentiality (legal, accounting).

- Perceived unprofessionalism (corporate offices rarely solicit Google reviews).

Example:

- A warehouse or shipping company operates on B2B contracts—not customer-facing interactions.

5. Misclassification or Lack of Online Presence

Some businesses might:

- Not be properly listed on review platforms.

- Operate offline (e.g., local freight agencies relying on direct calls).

- Use alternative platforms (e.g., Facebook for marketing agencies).

Key Takeaways & Opportunities

✅ B2B Bias: Many zero-review categories serve businesses, not retail consumers.

✅ Professional Discretion: Legal, financial, and architectural services avoid public reviews by nature.

✅ Market Growth Potential: Some sectors (e.g., internet marketing) may still be developing locally.

✅ Untapped Digital Presence: Businesses could benefit from encouraging client feedback (where appropriate).

Recommendations for Businesses in These Categories:

- B2B firms: Leverage LinkedIn, case studies, or industry directories instead of Google Reviews.

- Professional services: Request testimonials for websites rather than public platforms.

- New/local businesses: Improve Google My Business listings to attract reviews from early clients.

Highlight – What Lack of Reviews Mean

The lack of reviews does not necessarily mean poor quality—it often reflects the nature of the industry (B2B, professional discretion, or emerging markets). However, businesses in these categories could explore alternative reputation-building strategies beyond traditional review platforms.

Top Categories according to Ratings

In Dasmarinas, Cavite, here are the top 10 categories with the highest average rating among businesses with at least 100 total reviewers:

- Caterer: 4.90 average rating

- Internet marketing service: 4.90 average rating

- Seafood: 4.70 average rating

- Filipino: 4.70 average rating

- Italian: 4.61 average rating

- Catholic church: 4.60 average rating

- Real estate developer: 4.60 average rating

- Event venue: 4.60 average rating

- Veterinarian: 4.60 average rating

- Coffee shop: 4.57 average rating

The data provides insights into the business landscape and consumer preferences in Dasmarinas, Cavite. Here are some possible meanings and inferences:

1. High-Quality Service Industries

- Caterers and Internet marketing services topping the list (4.90) suggest strong customer satisfaction in these sectors, possibly due to professionalism, reliability, and quality offerings.

- This could indicate a growing demand for catering (events, parties) and digital marketing services in the area.

2. Strong Food Culture

- Seafood, Filipino, and Italian restaurants have high ratings, reflecting a vibrant dining scene with well-received local and international cuisine.

- Filipino cuisine’s high rating (4.70) suggests pride in local flavors, while Italian’s presence indicates appreciation for foreign tastes.

3. Community and Lifestyle Trends

- Catholic churches (4.60) scoring high aligns with the Philippines’ deeply rooted religious culture, showing that places of worship maintain strong community engagement.

- Coffee shops (4.57) reflect a growing café culture, possibly driven by students, professionals, and social meetups.

4. Real Estate and Event Demand

- Real estate developers (4.60) and event venues (4.60) performing well may signal urbanization, economic growth, and a rise in weddings, corporate events, or family gatherings.

5. Pet Care Importance

- Veterinarians (4.60) having high ratings suggests pet ownership is significant in Dasmarinas, with pet owners valuing quality animal care services.

6. Possible Market Gaps

- Categories like healthcare, retail, or education aren’t in the top 10, which might imply they are either less reviewed or have lower satisfaction rates.

- If certain essential services (e.g., hospitals, schools) are missing, it could highlight areas needing improvement.

7. Trust in Local Businesses

- High ratings across diverse categories indicate that Dasmarinas businesses generally meet or exceed customer expectations, fostering trust and loyalty.

8. Tourism and Local Economy

- The strong performance of food, events, and real estate could mean Dasmarinas is attracting visitors or new residents, boosting the local economy.

Highlight: Top Rated Categories

The data suggests Dasmarinas has a thriving service industry, a food-loving community, and a blend of traditional and modern lifestyle preferences. Businesses in high-rated categories likely prioritize customer experience, while gaps in other sectors may present opportunities for growth.

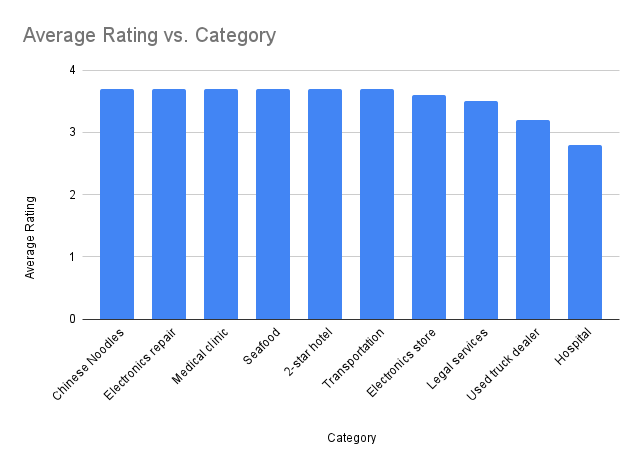

Contrasting the Lowest Rated Categories

The lowest 10 categories according to average rating:

- Chinese Noodles = 3.7

- Electronics repair shop = 3.7

- Medical clinic = 3.7

- Seafood = 3.7

- 2-star hotel = 3.7

- Transportation service = 3.7

- Electronics store = 3.6

- Legal services = 3.5

- Used truck dealer = 3.2

- Hospital = 2.8

Lowest Rated – Broader Trends & Possible Systemic Issues

🔴 Essential Services Are Failing – Healthcare, legal, and transport are critical yet poorly rated, suggesting lack of investment or regulation.

🔴 Low Trust in Repairs & Used Goods – Electronics and truck dealers suffer from perceived dishonesty.

🔴 Weak Hospitality & Food Subcategories – Not all dining and lodging is thriving; some segments disappoint consumers.

Lowest Rated – Business & Policy Implications

✅ Healthcare & Legal Reforms Needed – Authorities or private investors should investigate why hospitals and clinics perform so poorly.

✅ Stricter Consumer Protection – Used car dealers and electronics shops may need better oversight to prevent scams.

✅ Transport Modernization – Ride-hailing integrations or better public transit could improve ratings.

✅ Food & Hospitality Upgrades – Seafood and Chinese noodle restaurants should reassess quality and pricing.

Highlight: Lowest Rated Categories

The lowest-rated categories is a manifestation of critical gaps in essential services, particularly healthcare, transportation, and professional services. Businesses in these sectors should analyze customer complaints and improve transparency, reliability, and service quality. Meanwhile, policymakers might consider industry regulations or incentives to uplift these underperforming areas.

For consumers, this data suggests caution when using these services and possibly seeking alternatives outside Dasmarinas for healthcare, legal aid, and electronics needs.

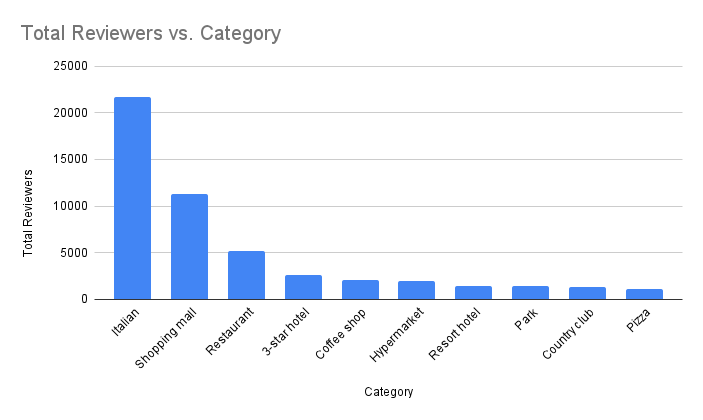

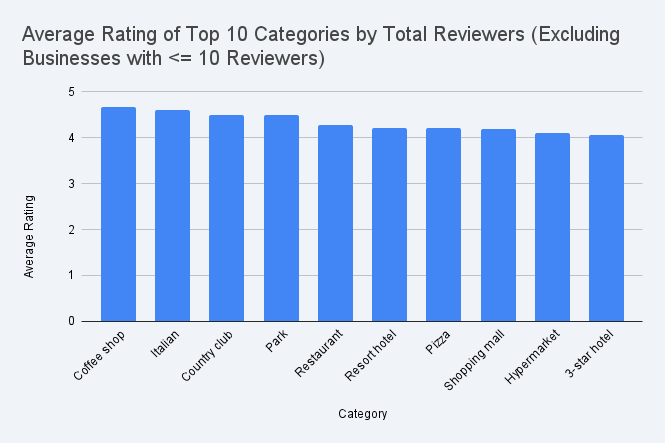

Average Ratings of Top Reviewed Categories in Dasmarinas, Cavite

Focusing on categories with the highest total reviewers (excluding businesses with ≤10 reviews). The ratings are slightly lower than the previous list (where niche categories had near-perfect scores), suggesting that popular, frequently reviewed businesses tend to have slightly more varied customer experiences.

With rating of 5 still the highest, the following list shows the average rating of the top 10 categories by total reviewers (excluding businesses with 10 reviewers and below).

- Coffee shop = 4.672222222

- Italian = 4.602857143

- Country club = 4.5

- Park = 4.5

- Restaurant = 4.279166667

- Resort hotel = 4.222222222

- Pizza = 4.22

- Shopping mall = 4.2

- Hypermarket = 4.1

- 3-star hotel = 4.066666667

Key Observations & Possible Meanings:

1. Coffee Shops Lead in Popularity & Satisfaction (4.67)

- Inference: Coffee culture is strong in Dasmarinas, likely driven by students, remote workers, and social meetups.

- Why? High ratings suggest customers consistently enjoy the ambiance, service, and quality of local cafés.

2. Italian Cuisine Highly Rated (4.60), Pizza Lower (4.22)

- Inference: Full-service Italian restaurants perform better than pizza-focused spots.

- Why? Sit-down Italian dining may offer better experiences than fast-food or delivery pizza.

3. Leisure & Recreation (Country Clubs, Parks, Resorts) Score Well (4.2–4.5)

- Inference: Residents value outdoor and recreational spaces.

- Why? Country clubs and parks (4.5) suggest demand for family-friendly and upscale leisure activities.

- Resort hotels (4.22) indicate weekend getaways or staycations are popular.

4. General Restaurants (4.28) vs. Pizza (4.22) & Hypermarkets (4.1)

- Inference:

- Restaurants perform decently, but not as strong as specialized cuisines (Italian, coffee shops).

- Pizza places may struggle with consistency or competition.

- Hypermarkets (4.1) and malls (4.2) have acceptable but not outstanding ratings—hinting at room for improvement in customer experience.

5. Shopping Malls & Hypermarkets (4.1–4.2) – Functional but Not Exceptional

- Inference: People visit malls and hypermarkets out of necessity rather than exceptional service.

- Why? Ratings are decent but not outstanding—suggesting congestion, pricing, or service could be pain points.

6. 3-Star Hotels (4.07) – Lowest in the List

- Inference: Budget accommodations meet basic needs but may lack premium amenities.

- Why? Compared to resorts (4.22), hotels may have fewer luxuries, affecting ratings.

Broader Trends & Business Insights:

✅ Strong Café & Dining Culture – Coffee shops and Italian food thrive, indicating a preference for social and experiential dining.

✅ Demand for Leisure Spaces – Parks, country clubs, and resorts suggest residents prioritize relaxation and family time.

⚠ Room for Improvement in Retail & Fast Food – Malls, hypermarkets, and pizza places have decent but not stellar ratings.

⚠ Hospitality Sector Variance – Resorts outperform hotels, implying that guests prefer leisure-focused stays over basic lodging.

Possible Opportunities:

- Improving mid-tier dining (restaurants, pizza) to match the success of Italian and coffee shops.

- Enhancing retail experiences (malls, hypermarkets) to boost customer satisfaction.

- Upscaling budget hotels to compete with resorts in comfort and service.

Highlight: Top Reviewed Categories

Dasmarinas has a vibrant food and leisure scene, with coffee shops and Italian dining leading in both popularity and satisfaction. However, retail and fast-food sectors could improve, while recreational spots remain a strong preference. Businesses in lower-rated categories should analyze customer feedback to identify improvement areas.

SWOT Analysis of Dasmariñas, Cavite Business Landscape

✅ STRENGTHS (High-Rated Sectors)

- Thriving Food & Leisure: Coffee shops (4.67), Italian (4.60), parks/resorts (4.5+) show strong demand.

- Reliable Services: Caterers (4.90), internet marketing (4.90), veterinarians (4.60) excel in quality.

- Community Trust: Catholic churches (4.60) and event venues (4.60) reflect engaged customers.

Action: Promote these sectors as local strengths; encourage tourism and partnerships.

❌ WEAKNESSES (Low-Rated Sectors)

- Critical Service Gaps: Hospitals (2.8), clinics (3.7), legal (3.5) fail to meet expectations.

- Tech/Repair Distrust: Electronics stores (3.6) and repair shops (3.7) suffer from poor service.

- Transport & Hospitality Issues: 2-star hotels (3.7), transportation (3.7) deter satisfaction.

Action: Invest in healthcare upgrades, enforce consumer protections, and modernize transport.

🚀 OPPORTUNITIES (Gaps & Trends)

- B2B Growth: Zero-review sectors (freight, accounting, architecture) can dominate with digital outreach.

- Food & Retail Upscaling: Improve seafood (3.7), pizza (4.22), and malls (4.2) to match top performers.

- Tech & Healthcare Demand: Fix electronics repair (3.7) and clinics (3.7) to capture unmet needs.

Action: Launch B2B marketing campaigns; incentivize quality upgrades in weak categories.

⚠ THREATS (Risks to Address)

- Consumer Distrust: Low ratings in essentials (healthcare, legal) may push residents to neighboring cities.

- Competition: Nearby areas could attract Dasmarinas’ customers if services don’t improve.

- Reputation Damage: Persistent poor reviews in key sectors could hinder economic growth.

Action: Implement local business training programs; collaborate with regulators to raise standards.

Quick Strategic Priorities

- Leverage Top Performers: Market high-rated sectors (cafés, catering) to boost tourism.

- Fix Weak Links: Partner with hospitals, transport, and electronics shops to improve ratings.

- Activate B2B Networks: Encourage professional services to build visibility on LinkedIn/niche platforms.

- Monitor Competitors: Track nearby cities’ offerings to prevent customer drain.

Final Tip: Use customer feedback from low-rated sectors to drive targeted improvements.

Actionable Steps for Stakeholders

For Businesses:

✔ Claim & optimize GMB profiles (photos, accurate info, responses to reviews).

✔ Encourage satisfied customers to leave reviews (e.g., QR codes on receipts).

✔ Address negative feedback publicly (show accountability).

For Consumers:

✔ Leave honest reviews to help others make informed choices.

✔ Report fake or misleading reviews to maintain platform integrity.

For Local Government & Trade Groups:

✔ Launch a “Quality Pledge” program to certify highly rated businesses.

✔ Educate SMEs on review management (workshops, templates for responses).

Leave a Reply